A fund for qualified investors with attractive investment assets

Mezzanine Capital Fund SICAV, a.s., Sub-Fund Loan is a unique fund for qualified investors, specializing in the Czech Republic in providing loans to small and medium-sized enterprises to support the realization of their investment plans—primarily in the areas of acquisitions and large-scale investment projects.

The fund’s investment strategy aims to deliver long-term stable and above-average returns for investors by offering mezzanine loans. These loans enable companies, family-owned holdings, or investment groups to access additional capital for projects that would otherwise be difficult to fully finance through traditional debt instruments. The higher (yet controlled) risk associated with mezzanine financing also comes with higher interest rates, and therefore the potential for higher expected returns for investors.

The fund’s strategy is based on the long-standing transactional experience and proven track record of its professional advisor, Mezzanine Capital s.r.o.

Professional credit risk management is the cornerstone of the fund’s strategy.

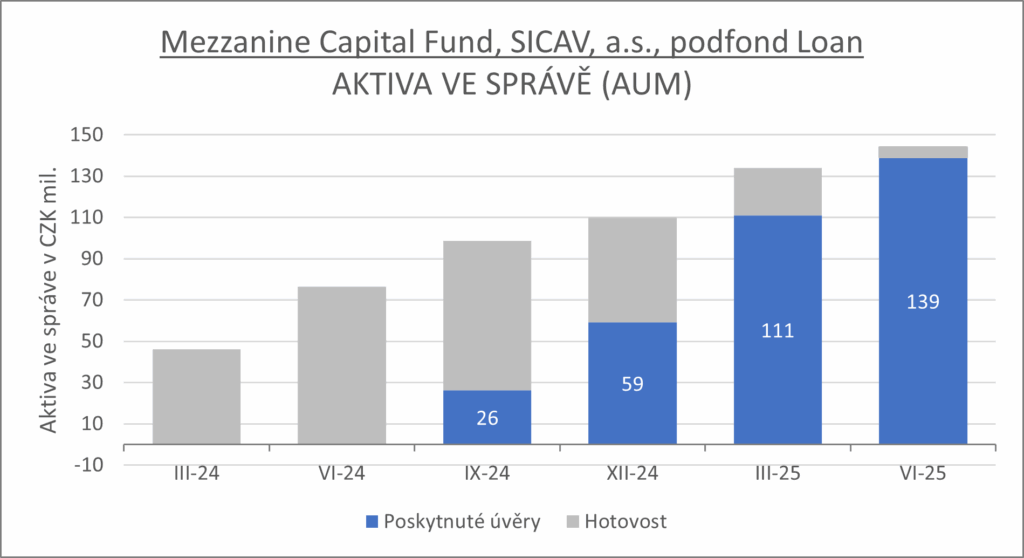

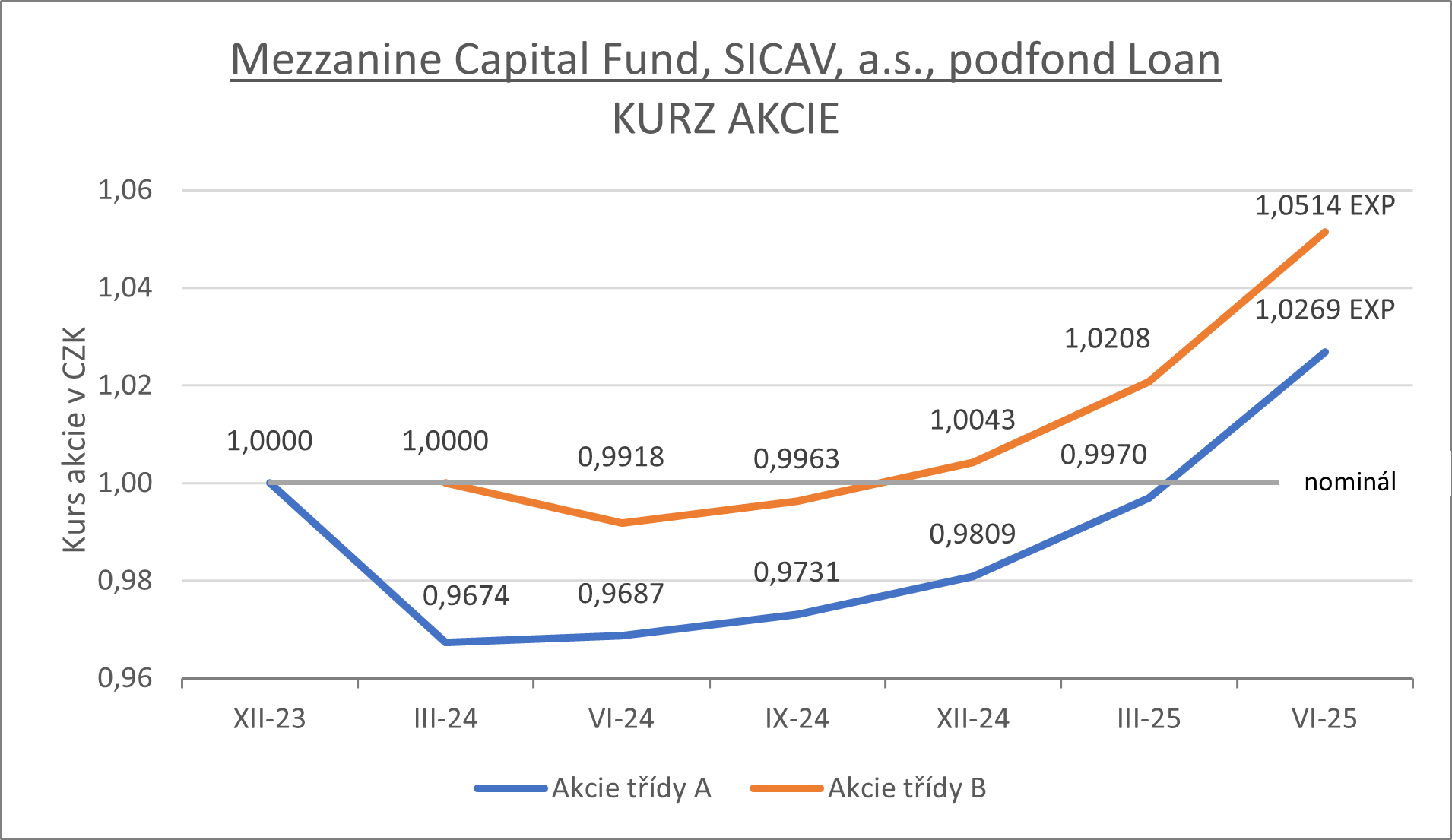

Fund portfolio size and investment share price as of 31.03.2025:

The values as of 30.6.2025 are the founders’ expert estimate

The fund’s target return is projected at 9–11% p.a.

Founders of the fund

Founding Partner

Jan has over 18 years’ experience in Corporate Banking, Structured Finance, and Commercial Real Estate finance. He started his banking career in HypoVereinsbank (currently UniCredit Group) in the Risk Management Department in 1997. Subsequently, he transitioned to the position of Structured Finance Specialist within the Corporate Banking Division in 2002. In 2007 he was promoted to the position of Director for the Structured Finance and Commercial Real Estate Finance with direct reporting to the Board of the Bank.

Jan holds a Master Degree in Economics from the University of Economics in Prague and a Master Degree in Law from the Faculty of Law at Charles University in Prague.

Founding Partner

Before founding Mezzanine Capital, Roland spent over 8 years in consulting. He worked as Managing Director at the Prague office at Roland Berger; a leading global consultancy group with responsibility for the Czech Republic and Slovakia. Prior to this, he spent over 10 years in various industries as CEO and interim manager by managing companies with 500+ employees in Hungary, Slovakia and Germany.

Roland holds a Master Degree from the University of Economics (Faculty of International Trade) in Bratislava and an MBA from The Open University in Milton Keynes, UK.

Founding Partner

22 years of experience in financing real estate acquisitions at financial institutions such as Raiffeisenlandesbank Oberösterreich and DeutscheBank. 6 years of experience in financial structuring, management, and fundraising for investment funds. Founding partner of the investment group ZDR Investments, First Veterinary Fund Central Europe, and the technology-focused PRIME FUND SICAV.

We live our core corporate values

Trust between us and our clients, investors, employees, and shareholders is an integral part of our services.

We offer exceptional innovative solutions tailored to the specific needs of our clients.

We believe in mutually beneficial relationships and collaboration based on the principles of transparency and equality.